Content

- How do I file an appeal against a decision that was made on my claim?

- What Are the Penalties for Failing to Meet the 1099 Filing Deadline?

- How do I request interpreter services or special accommodations for my appointment?

- Are unemployment benefits taxable?

- What Are the 1099 Late Filing Penalties?

- Penalties and Interest for Individuals

- How to file a 1099 after the deadline

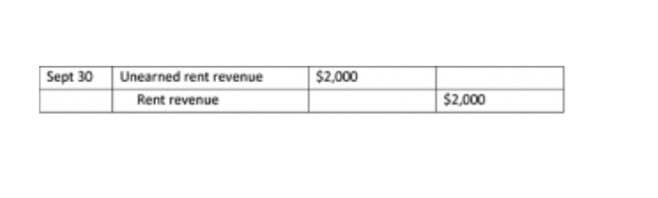

For more information about the interest we charge on penalties, see Interest. As with filing a dispute, your IRS notice should have instructions to request penalty relief. The IRS will also charge interest on these penalties if you ignore them. It’s a good idea to pay as soon as you receive the IRS notice, assuming it’s warranted. Next to the “CORRECTED” checkbox there is a “VOID” checkbox. If you have mistakes on a completed 1099 and have not submitted it to the IRS, you can void it.

And if you make a mistake on either form, you may need to issue a corrected 1099. The general rule is to issue a 1099-MISC to each individual contractor or vendor you paid at least $600 over the course of the calendar year. This form requirement doesn’t usually apply to your expenditures on hobbies or personal items, just business activities. In most cases you do not have to issue 1099-MISCs to corporations – just other individuals and partnerships. If you file late, we will charge a penalty unless you have a valid extension of time to file. It’s essential to consult a tax professional if you own a business and are unsure about issuing 1099s.

How do I file an appeal against a decision that was made on my claim?

Don’t worry, we’ve rounded up all the important dates you need to know about so you don’t miss any. If the payment is for fees paid for attorney services, use the 1099-NEC form. Report gross proceeds, such as escrow or claimants (but not for attorney https://www.bookstime.com/articles/stockholders-equity services) on Form 1099-MISC. These payments are reportable if you paid at least $600 during the year. For both forms 1099-MISC and 1099-NEC, you must report any federal income tax you withheld from payees under backup withholding rules.

- Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors.

- The IRS will accept filings by the business day following the specified date if it falls on a Saturday, Sunday or legal holiday.

- If you decline a job referral or do not apply for a job referral provided by a RESEA specialist, your claim will be under review and your benefits may be stopped.

- The submission date to the IRS will be different for the clients and taxpayers.

- If the IRS finds anything wrong with your 1099 or that you neglect to file one, they have 3 years to take action.

Different types of 1099 penalties won’t stack — you’ll only have to pay the highest penalty you’re assessed on a single form. Waiting till fall to send all five 1099 forms to both the IRS and your recipient gets you a penalty of $2,700. While she’s not hiking in the Smoky Mountains or checking missed 1099 deadline out new breweries (@travelingcpachick), she’s working on growing her own financial services firm. Kristin is an advocate and affiliate partner for Keeper Tax. Your first RESEA appointment and any follow up appointments are designed to provide employment assistance and a mix of services.

What Are the Penalties for Failing to Meet the 1099 Filing Deadline?

The value of the investment may fall as well as rise and investors may get back less than they invested. You can mail in documentation, or use the IRS Filing Information Returns Electronically system (FIRE) to expedite the process. As long as you have your data ready, you may be able to complete your 1099-MISC in just a few minutes.

But remember the independent contractors that provide you services during the year need their 1099-MISC form just like employees do their W-2s. Most employers are used to getting W-2s out to their employees by the end of January. However, it’s not just employees who are waiting by the mailbox this time of year. The independent contractors that provided you services during the year most likely need a form of their own by the end of January as well—a 1099-MISC. Unemployment benefits are paid to a debit card provided by the state’s vendor, Conduent.

How do I request interpreter services or special accommodations for my appointment?

If you work with self-employed independent contractors or gig workers, get ready to file a 1099 form this tax season. While balancing multiple deadlines and different forms to file, you may miss a deadline or submit an inaccurate return. When that happens, the IRS will send you a notice of a 1099 late filing penalty (or penalties) detailing what you owe to correct the situation.

The 1099 tax form is not a tax form in the traditional sense because it is not technically required by an individual to file their taxes. Every business is required to file a 1099 to the Internal Revenue Service and provide a copy of the 1099 to the taxpayer so it can be used for income tax preparation. Incorrect 1099’s are penalized on the same schedule as returns that are filed late.

The IRS requires that payers withhold this tax in several circumstances. For example, if you submit your IRS return after the filing deadline but before August 1, you must pay $110 for each late 1099. If you do not submit your return, you must pay a much higher penalty of $290 per return. Filing a Form 1099 after August 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the IRS charging you a $290 penalty.

If you make a mistake while filling out a 1099 form but have not yet sent it to the IRS, you can mark the 1099 as void to prevent the IRS from processing it. After submitting the 1099, you must submit a corrected form to fix an error. The penalty for intentionally disregarding submitting forms 1099 starts at $580, and there is no maximum penalty you may be assessed per form. If you miss the deadline to file your 1099 forms, you can still file, but you may incur a late penalty. If the regular due date falls on a weekend or federal holiday, you must file by the next business day. A simple way to ensure you file your 1099s on time is by asking any sole proprietor or freelancer you deal with to fill out the W-9.

What Are the 1099 Late Filing Penalties?

There are many software packages available in the market that you might want to explore if you’re going to do the filing in-house. But remember, if you’re going to process 1099-MISC forms in house, you need to mail payee copies as well, which can be very time-consuming. An online service provider takes care of mailing as well as electronic filing. Form 1099-MISC must be filed with the IRS by February 28 if filing on paper and March 31 when filing electronically. You must also provide a payee statement to your recipients by January 31.

For most self-employed people, filing a 1099 means filing Form 1099-NEC specifically. It’s used to report “nonemployee compensation” — meaning, payments to vendors and independent contractors. It is possible to work part-time and still draw unemployment. You must report the hours worked and gross amount of money you earned before any deductions were made.

Penalties and Interest for Individuals

I have a client that missed the 1099 Deadline because of waiting on bank to provide checks that needed entered (they didn’t keep a log, and didn’t know who they paid). The time delay means you may have a chance to correct obvious errors, so don’t just put arriving 1099s in a pile. Here are 10 things you should know about your 1099s, including a review of the various types and what to do if you don’t receive your 1099 or it’s inaccurate. If the IRS finds anything wrong with your 1099 or that you neglect to file one, they have 3 years to take action. Extension requests for Form 1099-NEC and Form 1099-QA can only be submitted on paper. On the second 1099 form, fill out the second form with the correct information, like you would an original form.